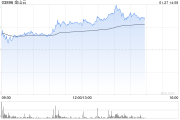

万通发展股价波动引发投资者质疑:是否存在市值管理问题?

近日,投资者在互动平台上向万通发展(600246)提出尖锐质疑, questioning the company’s share price volatility and hinting at potential market manipulation. The investor’s question, referencing the idiom “人在做天在看,” expresses concern over the company’s share price performance, particularly its sharp rises and falls this year, which they deem unusual and potentially indicative of illegal or irregular activities. They specifically inquired about the possibility of margin calls on leveraged funds used for market capitalization management and whether the company had engaged in any non-compliant actions, such as manipulating stock prices.

The company’s response was brief and somewhat defensive. They acknowledged the investor’s concerns but attributed the price fluctuations to various market factors, including investor sentiment, while asserting that the company’s operations are currently normal. This response, while adhering to a standard corporate PR approach, falls short of directly addressing the core of the investor’s worries. The lack of concrete refutation or detailed explanation leaves room for continued speculation.

This situation highlights several critical aspects of corporate governance and transparency in the Chinese stock market. First, the investor’s concern about potential market manipulation underscores the need for stricter regulations and more robust oversight mechanisms to prevent such practices. Second, the company’s somewhat evasive response emphasizes the importance of proactive and transparent communication between listed companies and their investors. A more detailed response, perhaps addressing specific aspects of their trading practices and market capitalization strategies, could have improved investor confidence.

The incident also raises broader questions about the behavior of institutional investors and the impact of leveraged trading on market stability. Further investigation is warranted to determine whether any regulatory violations occurred. The overall situation serves as a reminder that while market volatility is inherent, unusual price swings demand scrutiny to ensure fair and transparent market practices.

This incident should also serve as a case study for financial institutions and regulators, highlighting the need for improved market surveillance, enhanced investor protection, and the development of clearer guidelines on corporate disclosure related to market capitalization management practices. The future will likely see increased scrutiny of such activities, demanding a more proactive and transparent approach from listed companies.

相关文章

-

万科获得深圳国资大力支持,龙年A股市场电子行业领涨详细阅读

万科A发布公告,预计2024年净利润亏损约450亿元,但深圳市国资委表示将全力支持万科稳定发展,提供充足资金支持,降低地铁集团负债率,增强其流动性。万...

2025-02-04 22

-

2024年12月中国上市公司市场月报:境内外上市公司数量及趋势分析详细阅读

2024年12月,中国上市公司市场呈现出境内外上市公司数量持续增长,以及境内公司赴海外上市趋势加剧的态势。根据中国上市公司协会发布的月报数据,截至20...

2025-02-02 47

-

NATIONAL ELEC H(00213.HK)股票回购及注销公告深度解读详细阅读

NATIONAL ELEC H(00213.HK 近期一系列股票回购及注销操作引发市场关注,本文将对此进行深度解读。 根据格隆汇1月27日报道,NA...

2025-02-02 46

-

链达科技2024年预计上交所上市公司投资收益亏损5020万元详细阅读

链达科技(000761.SZ 发布公告,预计2024年度归属于上市公司股东的净利润亏损5020万元。这表明公司在投资方面遭遇了重大挫折,其投资策略和风...

2025-02-02 67

- 详细阅读

- 详细阅读

-

A股震荡走强,中长期资金入市,春季行情可期?深度解析及投资建议详细阅读

上周A股市场展现出震荡走强的积极态势,主要宽基指数悉数飘红。这一走势与近期发布的《关于推动中长期资金入市工作的实施方案》密切相关,该方案的出台有效提振...

2025-02-01 54

- 详细阅读

发表评论